Robo-Advisors vs. Human Advisors: Choosing the Right Path for You

The field of investment management has changed dramatically and now offers people several choices to negotiate their financial paths. Among these options, human financial advisers and robo-advisors stand out as both having different approaches to wealth management and clear benefits. Investors trying to match their tactics with their own objectives and preferences must grasp the subtleties of these two choices. This research will clarify the advantages and drawbacks of robo-advisors and human advisers, therefore enabling you to make a well-informed choice catered to your particular financial situation.

Understanding the Role of Robo-Advisors

Offering a reasonably priced substitute for conventional financial advisers, robo-advisors use technology and algorithms to manage investment portfolios. Usually requiring little human participation, they are easily available for anyone looking for simple investing plans. Users enter their risk tolerance and financial goals, and the system creates an automatically rebalanced customized portfolio over time. Tech-savvy investors seeking efficiency and ease of use will find attraction in this automated strategy. Though they are quite good at handling assets, robo-advisors might not provide the individualized advice and emotional support some investors find necessary during market swings.

The Benefits of Human Financial Advisors

Human financial advisers provide individualized service fit for a person’s goals and situation. During market instability, they offer emotional support to enable customers confidently negotiate difficult financial decisions. Ensuring a complete approach to wealth management, these experts may evaluate a client’s whole financial situation including tax consequences, estate planning, and retirement alternatives. Their capacity to create bonds also promotes confidence, which is rather important for long-term financial planning. For individuals looking for a more hands-on financial experience, human advisers are a great tool since their knowledge allows them to customize plans fit for customers’ values and goals.

Factors to Consider When Choosing Between Robo-Advisors and Human Advisors

When choosing between human advisers and robo-advisors, various considerations come into play. First, take into account your comfort level and investment knowledge; tech-savvy people might want the automated approach, while those looking for direction could go towards human experience. Evaluate the intricacy of your financial situation; typically, complex demands gain from individualized guidance. Analyze fees as robo-advisors usually have less expenses but human advisers could justify more prices with customized services. At last, consider your communication style; if you value in-person meetings, a human advisor could be more suited; on the other hand, people who prefer digital solutions could find robo-advisors more interesting.

Making the Decision: Which Path is Right for You?

Choosing the right course of action for your financial situation calls for serious consideration of your own choices and circumstances. Start by assessing your risk tolerance, investment objectives, and degree of desired support. A robo-advisor can be appropriate if you want a low-key strategy with less expenses. On the other hand, a human advisor could be the better option if you need tailored guidance and a closer knowledge of difficult financial issues. Take also into account your technological comfort and your demand for emotional comfort amid market swings. In the end, a more fulfilling investing experience results from matching your choice with your communication style and financial goals.

Individual tastes and particular financial demands will determine whether one prefers robo-advisors over human financial advisers. Every choice has benefits; robo-advisors offer efficiency and reduced costs, while human advisers provide tailored insights and emotional support. Thoughtfully evaluating your investing goals, familiarity with technology, and the complexity of your financial circumstances will help you to decide in line with your own style of wealth management. In the end, the correct decision will enable a more efficient and satisfying path of investing catered to your goals.

Photo Attribution:

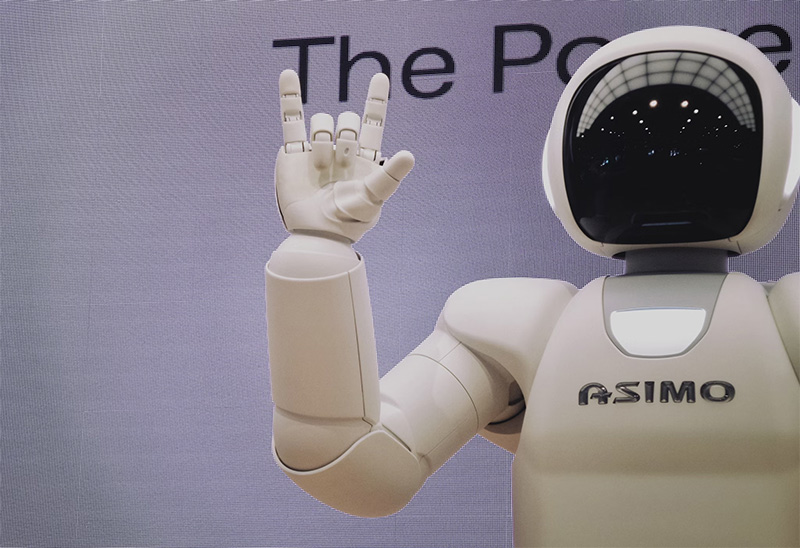

1st & featured image by https://unsplash.com/photos/asimo-robot-doing-handsign-g29arbbvPjo

2nd image by https://unsplash.com/photos/person-holding-pencil-near-laptop-computer-5fNmWej4tAA