Investing in Wine: A Vintage Approach to Portfolio Diversification

Wine, a beverage steeped in history and cherished by connoisseurs, has evolved into a captivating investment opportunity. Its allure lies not only in its taste but also in its potential for financial gain. With a rich legacy of trade and collection, wine has proven its ability to appreciate in value over time. Today, seasoned investors and enthusiasts alike are drawn to the unique combination of scarcity, craftsmanship, and the potential for appreciation that wine offers. By carefully considering factors such as provenance, market trends, and storage conditions, investors can navigate the world of wine investment and build a portfolio that aligns with their financial goals.

The History of Wine as an Investment

Wine, with its rich and storied history, has long been more than just a beverage. For centuries, it has captivated the hearts and palates of connoisseurs around the world. However, its allure extends beyond mere enjoyment; wine has proven to be a lucrative investment opportunity. Dating back to ancient times, wine has been traded and collected, often gaining value over time. In recent decades, the concept of investing in wine has gained traction, attracting both seasoned investors and enthusiasts alike. The unique combination of scarcity, craftsmanship, and the potential for appreciation has made wine an intriguing addition to diversified investment portfolios.

Factors to Consider When Investing in Wine

Investing in wine requires careful consideration of various factors to maximize potential returns. Firstly, the provenance and authenticity of the wine are crucial. A bottle’s origin, including the vineyard, vintage, and producer, significantly impacts its value. Additionally, the condition and storage history of the wine must be assessed to ensure its quality and preservation. Secondly, market trends and demand play a vital role. Researching and understanding the preferences of collectors and investors can guide decision-making. Moreover, economic factors, such as global wine consumption and emerging markets, should be evaluated to gauge the potential for future appreciation. By analyzing these factors, investors can make informed decisions and navigate the world of wine investment successfully.

Strategies for Building a Wine Investment Portfolio

When constructing a wine investment portfolio, several strategies can be employed to optimize returns. Firstly, diversification is key. Investing in a range of wines from different regions, vintages, and producers helps mitigate risks and capture potential gains from various market trends. Secondly, considering both short-term and long-term investment horizons is essential. Some wines may yield quick profits, while others may require patience for appreciation. Balancing these approaches can provide a well-rounded portfolio. Additionally, staying informed about the wine market through research, attending tastings, and consulting experts can help identify promising investment opportunities. By employing these strategies, investors can build a robust wine investment portfolio that aligns with their financial goals.

Risks and Rewards of Investing in Wine

Investing in wine presents both risks and rewards that investors should carefully consider. On the one hand, wine has the potential for significant financial gains. Rare and sought-after bottles can appreciate in value over time, especially if they are well-preserved and come from reputable producers. Moreover, wine investments offer diversification benefits, as they tend to have a low correlation with traditional asset classes. However, there are risks involved. Wine is a relatively illiquid asset, meaning it may take time to find buyers when selling. Additionally, market fluctuations, changes in consumer preferences, and the potential for counterfeit bottles can impact investment returns. Therefore, investors must weigh these risks against the potential rewards when considering wine as an investment avenue.

In conclusion, the history of wine as an investment is a testament to its enduring allure and potential for financial gains. With careful consideration of factors such as provenance, market trends, and storage conditions, investors can navigate the world of wine investment successfully. By employing strategies such as diversification and staying informed about the market, a well-rounded wine investment portfolio can be built. While risks exist, including illiquidity and market fluctuations, the rewards of investing in wine, such as appreciation and diversification benefits, make it an intriguing addition to diversified investment portfolios.

Photo Attribution:

1st and featured image by https://www.realsimple.com/health/nutrition-diet/red-wine-health-benefits

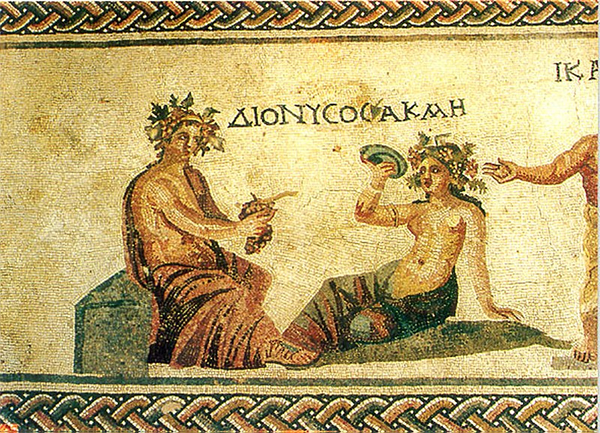

2nd image by https://upload.wikimedia.org/wikipedia/commons/6/6a/Dionysos_Akme_Paphos_mosaic.jpg