Best Personal Finance Apps to Keep Your Budget on Track

Management of personal finances may be easier said than done for many people. After all, not everyone is that organized and dedicated in keeping track of their expenses. However, personal finance management is very important if you want to make sure that you are on top of your budget and that you are able to save some for the rainy days.

It may require work and discipline, especially if this is something new to you. But you must do it if you want to achieve the goals mentioned. Like any other things that you are not familiar with, it would only be challenging at first. But once you get used to it, it wouldn’t be as difficult as it would already become part of your lifestyle.

To help you start managing your personal finances better, there are some apps that you may install on your phone to make the process even more convenient. Since these apps are installed on mobile devices, they allow you to keep track of your finances anytime, anywhere. Here are some of the best personal finance applications that you could try.

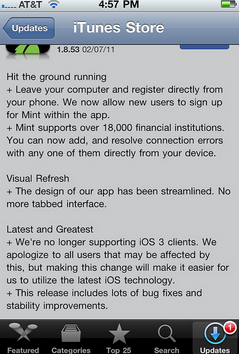

Mint Personal Finance

This is an award winning app that is used by more than 13 million people. Some of the awards it received are Hall of Fame from the App Store, Best Personal Finance App from WIRED App Guide and Best Apps to Manage Your Money from CNN Money. It also comes for free so there’s no reason why you shouldn’t give this app a try.

If you have several accounts where various bills are being taken each month, then managing your finances can be a bit complicated. This is where Mint comes in. This app is designed to keep track of the money that comes in and out on all of your accounts. With this, budgeting would be easier for you to do, even when working on several accounts and bills.

Level Money

This is an easy to use and free application with simple user interface. It’s straightforward, but very helpful in making sure that you do not overspend. There are times that you may tempted to purchase something that you didn’t plan for. But do you really have the budget for it?

There’s no need to crunch numbers in your head. Level Money would show you in real time how much you can spend for the day, for the week and for the month. It also shows your income, bills and savings. Through this, you can make a sound decision if you can go with the purchase or not. If you decide to push through, you would have an idea on the remaining amount that you can spend for the next days.

Check

This is another award winning app that is also free, safe and secured. It uses 128 bit encryption and it’s constantly being monitored by trusted security programs including McAfee and TRUSTe. The app is also secured by a 4-digit pin, which you can use for remotely deleting your information in case your phone got lost or stolen. Notifications will also be sent to you if there are suspicious charges and big purchases on your account.

What does Check specifically offer? The app gives you convenient access and view on all your bills and accounts in one single location. It also reminds you when there are bills due so you never have to miss them. This also means that you can say goodbye to penalties caused by late payments.

It does not just send you bill reminders as Check also lets you pay them right away from any of your accounts or schedule payments on a certain date so you wouldn’t forget them. Low funds? You will also be notified by the app, including when you are near your credit limit.

Spendee

This app is currently available at the App Store for $1.99. It has a gorgeous and sleek user interface. Spendee allows you to easily track your expenses for the day, week or even for a month. You would also see your total income so you could determine the amount that you can spend.

The application shows graphical charts that would quickly tell you which areas you are spending more. With this, you could decide properly on which of your expenses you can adjust in order to balance your budget.

These apps offer huge help in keeping your finances and budget on track. Give them a try and make personal finance management less stressful.

1st Image courtesy of patpitchaya / FreeDigitalPhotos.net

2nd Image Attributed to http://www.flickr.com/photos/Chris Messina/ / CC BY 2.0

3rd Image courtesy of cooldesign / FreeDigitalPhotos.net