Understanding the True Costs of Retirement Abroad

Retirement overseas presents a seductive possibility with the opportunity to discover different cultures and way of life. To guarantee a decent and sustainable living experience, nevertheless, good financial planning is very vital. Retirees have to budget holistically from knowing local expenses and healthcare options to negotiating tax consequences and currency swings. Through careful study of these components, people can maximize their retirement years and be ready for the reality of living overseas.

Cost of Living

Examining daily expenses is absolutely essential when thinking about retiring abroad. One place will have very different housing, groceries, healthcare, and transportation than another. While some locations may cause unanticipated financial challenges, others provide a reduced cost of living so retirees may stretch their resources further. Also affecting general affordability are changes in currency values. Research local rates and take lifestyle into account since eating out or participating in leisure activities may soon mount up. Knowing these elements guarantees a comfortable retirement overseas and helps to build a reasonable budget.

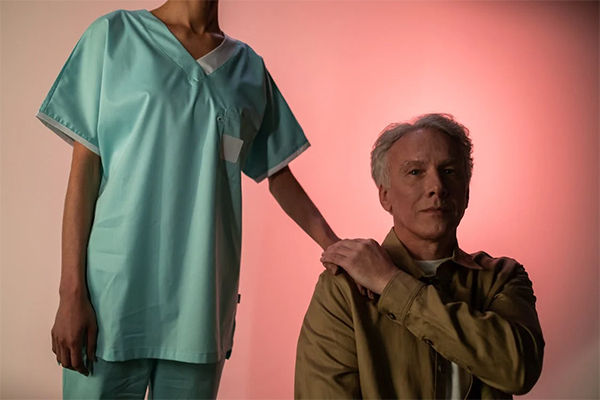

Healthcare Expenses

Retirees living abroad give great thought to access to high-quality healthcare. Although some nations provide reasonably priced healthcare, the degree of care and availability of specialists might differ greatly. Research the local healthcare system including insurance choices and out-of-pocket expenses for prescriptions and treatments. Many foreign workers choose private health insurance to guarantee they get appropriate and timely treatment. Furthermore, knowing how to negotiate the foreign healthcare scene helps to avoid unanticipated costs and guarantees piece of mind about medical requirements in retirement.

Taxes and Legal Fees

Dealing with the tax consequences of retiring overseas can be difficult and differs depending on the nation. Specific tax treaties between many countries and the United States affect the taxation of pensions, Social Security, and other income. Avoiding unanticipated obligations requires a knowledge of local tax legislation. Legal fees could also result from estate planning, property purchases, or residence setting-up. Hiring a seasoned local attorney will help to guarantee compliance and help to clarify rules. In these spheres, good planning helps to avoid expensive shocks and facilitates a more seamless transition into retirement in a different surroundings.

Currency Exchange and Inflation

The purchasing power of retirement funds can be much influenced by changes in foreign exchange rates. While a weaker dollar can result in more living expenses, a strong dollar may improve affordability in some countries. Monitoring economic developments is also crucial since host country inflation rates can gradually undermine savings. Retirees should think about ways to reduce these hazards, such keeping money in local currency or keeping a varied investment portfolio. Maintaining financial stability and enjoying their lifestyle free from unanticipated financial demands depends on retirees being current with financial matters.

A happy retirement overseas depends ultimately on meticulous preparation and extensive research. Retirees can make wise selections that fit their financial goals and lifestyle choices by knowing the subtleties of living expenditures, healthcare access, tax duties, and currency fluctuations. Accepting these factors not only improves the whole experience but also gives seniors security and stability in new surroundings so they may really enjoy their golden years.

Photo Attribution:

1st & featured image by https://www.pexels.com/photo/man-sitting-on-wooden-bench-wearing-black-leather-jacket-1377055/

2nd image by https://www.pexels.com/photo/nurse-holding-hand-of-elderly-man-9893524/