The Gig Economy and Your Finances: Navigating Taxes, Savings, and Retirement

In recent years, the gig economy has gained significant traction, with more and more individuals opting for flexible work arrangements rather than traditional nine-to-five jobs. While the gig economy offers freedom and autonomy, it also brings unique financial challenges. Navigating taxes, savings, and retirement becomes crucial for gig workers to secure their financial future. In this article, we will explore these three key areas and provide tips on how to manage them effectively.

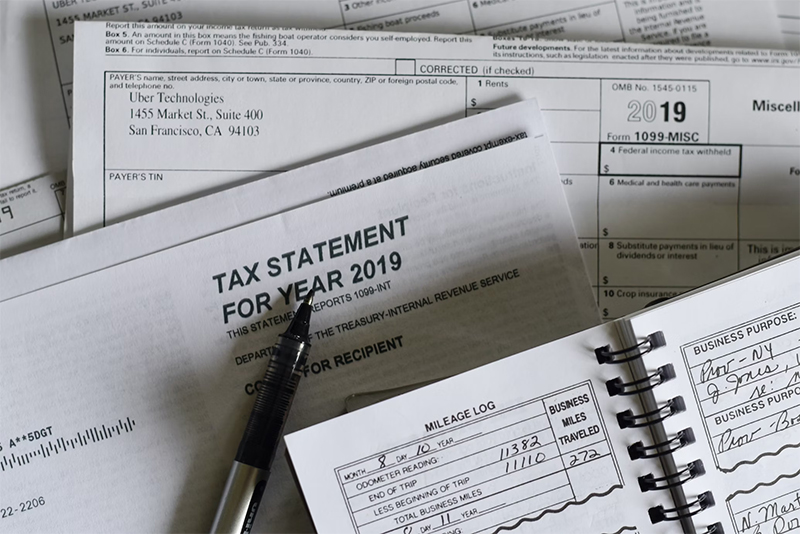

Taxes: understanding your obligations

In the gig economy, individuals often operate as ‘independent contractors’, making them responsible for managing their own taxes, which may include income tax, self-employment tax, and region-specific taxes. Proper management requires meticulous record-keeping, and fortunately, a variety of digital tools and accounting applications are available today to help ensure accuracy in tracking income and deductions. Nonetheless, the intricate tax rules can be overwhelming, making the expertise of a tax consultant crucial. Particularly for those versed in gig work nuances, such consultants can help optimize tax returns by identifying potential deductions and credits. In the gig world, while there’s freedom and autonomy, there’s also the imperative of proactive financial management to ensure tax compliance and optimize returns.

Savings: building a safety net

In the gig economy, income can be unpredictable, making it vital to build a robust savings cushion. Without the security of a steady paycheck, unexpected expenses or a slow period of work can quickly derail your financial stability. Aim to save at least three to six months’ worth of living expenses to protect yourself from unforeseen circumstances.

Automating your savings can help you stay on track. Set up automatic transfers from your gig income into a separate savings account. Treat this account as an emergency fund, only using it for essential expenses during lean periods. Additionally, consider establishing a retirement savings plan, such as an individual retirement account (IRA) or a simplified employee pension (SEP) IRA, to ensure you are saving for the future.

Retirement: planning for the long term

Retirement planning might seem like a distant concern for many in the gig economy, with present-day financial demands often taking precedence. Yet, the power of early savings, especially when coupled with compound interest, cannot be understated. It’s the key to ensuring a relaxed and secure retirement.

For those self-employed or in freelance roles, options like the solo 401(k) or the Simplified Employee Pension (SEP) IRA are worth exploring. Designed with the self-employed in mind, these accounts not only provide tax benefits but also allow higher contribution limits compared to standard IRAs. Beginning with a modest slice of your earnings and scaling it up as your freelance career flourishes can make a significant difference in the long run.

To enhance your retirement savings, consider venturing into low-fee index funds or ETFs. This approach helps in diversifying your investments, minimizing risks while optimizing returns. Given the intricacies of investment, it’s wise to bring a financial advisor on board. Their expertise will guide you in crafting a retirement strategy tailored to your aspirations and comfort with risk.

Conclusion

The evolving gig economy underscores the need for its participants to be financially astute. Beyond understanding taxes, having a robust savings buffer and planning for retirement are pivotal for enduring financial well-being. Through disciplined savings, leveraging tools tailored for freelancers, and harnessing expert insights, gig workers can effectively steer through financial intricacies. The mantra remains: In the gig world, the sooner you set the wheels of financial planning in motion, the smoother your journey towards a secured retirement will be.

1st and featured image by https://unsplash.com/photos/5616whx5NdQ