Investing in Comics and Memorabilia: A Unique Asset Class

Investment decisions are influenced by the distinct and noteworthy asset class that comic books and mementos have developed into. The lengthy history and widespread appeal of these goods have drawn investors to search for novel avenues for financial gain. They are in great demand. Fans like vintage movie posters, autographed souvenirs, and characters from DC and Marvel Comics. Comic book movies and TV shows are becoming more and more well-liked, and viewers and sponsors are beginning to recognize their cultural value and potential.

The Growth of Memorabilia and Comic Books Collecting

Recent years have witnessed several noteworthy advancements in the financial industry. Comic books and keepsakes are two new and profitable asset categories. Due to these products’ long history and popularity, investors are looking for new ways to make money. They are highly sought out. Vintage movie posters, personalized mementos, and DC and Marvel Comics figures are popular among fans. Viewers and sponsors are starting to appreciate the cultural significance and promise of comic book movies and TV series as they grow in popularity.

Evaluating the Investment Potential of Comics and Memorabilia

Purchasing books or antiques involves a number of factors. Quality and scarcity are valued by purchasers and collectors of rare, well-kept antiquities. Special editions, debut appearances by well-known characters, and important issues are extra-charged items. Trends and market demand are also significant. You may predict growth by looking at social trends, new film releases, and character success. Lastly, being aware of the rating and certification processes ensures that the products are genuine and valuable. Investors may choose this unique asset class wisely by considering these characteristics.

Strategies for Investing in Comics and Memorabilia

Arrange the comic books and mementos you buy to increase sales. The dangers brought on by fluctuations in the market are reduced by diversification. Original artwork, signed mementos, and comic books can all be included in a well-rounded portfolio. Researching and staying current with news and trends in the market is essential. Making knowledgeable investing selections may be aided by attending seminars, joining collector organizations, and speaking with professionals. If investors think long term and plan their departure, they may optimize returns and benefit from this special asset class’s continuing evolution.

Risks and Considerations in Investing in Comics and Memorabilia

Comics and souvenirs provide unique prospects, yet there are risks and concerns. Market swings pose a severe danger. Prices can be influenced by economic conditions, market trends, and a figure’s popularity. Additionally, the condition and authenticity of collectibles can have a significant influence on their value. Items lose value when they are badly kept, damaged, or fake. Cash may also be an issue because finding the right buyer might take time. Buyers should thoroughly evaluate the dangers and concerns before entering this specialized market.

Comic books and other collectibles are gaining in popularity. Buyers now have access to other assets. These pop culture relics are appealing to collectors and investors because of their long history, cultural relevance, and expanding demand. Before making an investment, evaluate the condition, rarity, market trends, and authentication methods. Investing in this specialized market can be profitable, but it also has market volatility, reliability, and liquidity difficulties. If they plan and stay current, investors may be able to withstand this volatile market and profit from the worth and desirability of these things.

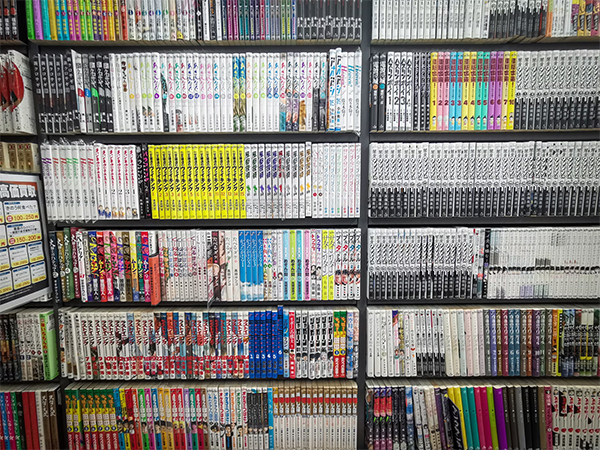

Photo Attribution:

1st and featured image by https://unsplash.com/photos/person-holding-opened-book-nUL9aPgGvgM

2nd image by https://unsplash.com/photos/books-on-black-wooden-shelf-HkpXmncGReQ