How to Set Financial Goals You Can Actually Achieve

Financial planning advice appears everywhere. The truth? Most people aren’t walking around with a spreadsheet in one hand and a quarterly review checklist in the other. Real life means forgotten budgets, unexpected car repairs, and coffee habits that seem trivial until the spending app starts yelling in red numbers. The solution isn’t some mystical formula whispered about in MBA classrooms; it’s practical action. People want goals that fit their income, their stress levels, their routines, not just ideals scrawled on whiteboards by consultants with too much time and too few bills. So what separates attainable financial targets from those doomed to collect digital dust?

Start Smaller Than You Think

Ambition fuels progress but kills more plans than laziness ever could. Promises to save half of a paycheck every month? It’s fantasy for most Americans juggling rent, groceries, and the occasional family emergency. A better start: pick numbers that almost feel laughable, fifty dollars set aside per week, or even ten if that’s all that fits without pain. That simple threshold lowers resistance. Success builds momentum like nothing else; see a small win, crave another. Can someone increase goals later? Absolutely, but only after consistency cements itself as habit.

Get Ridiculously Specific

Vague targets sink ships before launch. “Save more” means nothing by Friday afternoon, what exactly counts as ‘more’? Instead, break it down: “Save $600 toward an emergency fund by October 1st.” Now there’s clarity, a dollar amount paired with a deadline sharp enough to cut through any lazy excuse-making mind fog. This approach transforms ambiguity into accountability; nothing slips through the cracks when there are real numbers staring back from a phone screen or sticky note on the fridge. Unmistakable goals leave nowhere to hide when discipline falters.

Automate Everything Possible

Human willpower? Fleeting at best, especially late at night when scrolling through impulse buys feels easier than chopping up credit cards or logging onto banking apps again. Automation bypasses all that nonsense; money transferred automatically out of checking and into savings doesn’t give anyone time to debate whether this month’s concert tickets matter more than next year’s apartment security deposit refund check. Picture this: an invisible hand moving cash like clockwork each payday, no reminders needed, no guilt attached if life gets distracting.

Celebrate (Yes, Even Small Wins)

Nothing destroys motivation faster than waiting until some far-off finish line before allowing celebration, not in finances, not anywhere else either. Every milestone deserves recognition: the first hundred dollars saved or one credit card bill fully paid off warrants pizza night or skipping chores for Netflix time guilt-free. Forget puritanical self-denial; progress thrives on positive feedback loops and visible signs of movement forward, even when they’re minor compared to ultimate ambitions.

No magic wand exists for turning financial wishes into realities overnight, but neither does success demand ruthless discipline beyond human reach. Consistency beats intensity every single time; small steps add up shockingly fast once momentum gets rolling and goals remain crystal clear rather than vague dreams drifting just out of reach. Ignore perfectionism, real achievement depends on concrete actions repeated over weeks and months instead of heroic spurts followed by burnout and resignation back to square one.

Photo Attribution:

1st &featured image by https://www.pexels.com/photo/savings-tracker-on-brown-wooden-surface-732444/

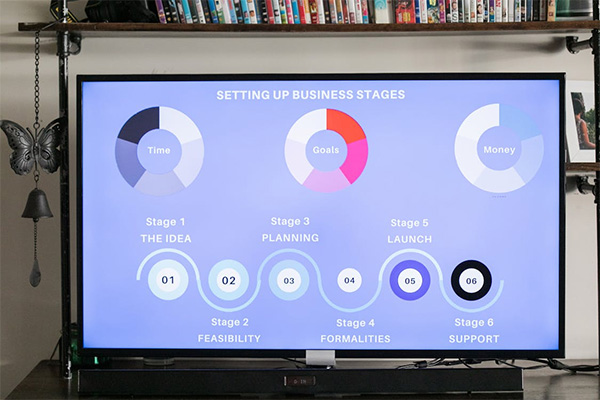

2nd image by https://www.pexels.com/photo/display-business-market-research-7948059/