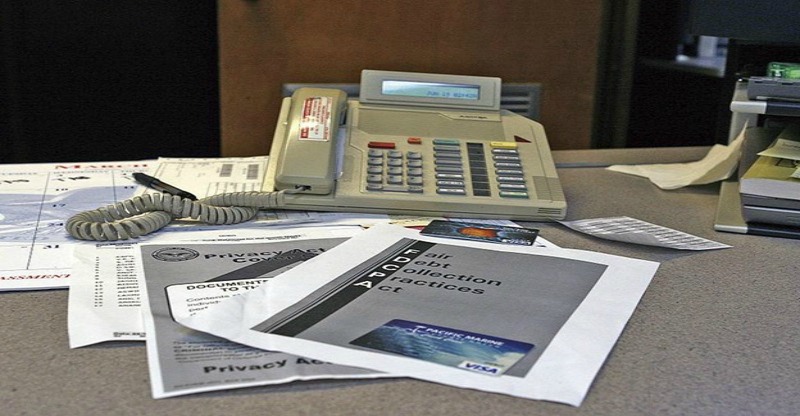

What to Do When You Get a Call from a Debt Collector Asking You to Pay Your Debt

When lenders are unable to collect what the borrowers owe, they often hire a debt collector to do the collection. They may also sell the debt to a debt collection agency, which then contact the debtor to request for payment. If you received an e-mail or a call from a debt collector, it could be scary, especially if it’s the first time that you experience such situation.

Remember that you also have rights when it comes to these collection practices. There are things that collectors are not allowed to do. Moreover, not all debts that are being collected by these collectors are accurate. Get to know your rights, as well as the steps that you need to take in case you get into this kind of situation.

What Are Your Rights

1. Ask to be contacted at your preferred time – collectorsare only allowed tocontact debtors from 8:00 am to 9:00 pm. However, if the said time is not convenient for you, you may send a request on what time you wish to be contacted. For instance, if your work schedule is from 10:00pm – 6:00 pm, let them know about it. Moreover, you may also request not be contacted at work, if this is what you want.

2. Request for debt verification – if you feel that you don’t owe anything, you may send a request to the collector asking them to verify the validity of the debt, as well as send you a proof that it’s yours and it has not been paid. This request can be sent within 30 days upon receiving your first collection notice. Once they received your request, you should not get any collection e-mail or call from them until they have the proof you requested.

3. You have the right of privacy – whether you really owe the debt being collected or not, the collectors should not disclose anything about this matter to other people, except your lawyer or spouse. If you’re under 18, they may also discuss this with your guardian or parents. If they can’t contact you for some reason, they may contact individuals who may know of your contact information. However, they are only limited to calling each person once.

4. You should not be harassed – the collector cannot threaten you or use foul language when collecting debts. They should also identify themselves properly and not tell you that they are lawyers or the authorities if they are not.

5. Sue the collector if your rights were violated – if any of these rights were violated, you have the option to sue the collector. Make sure to take note of all the calls and create copies of messages sent and receive to back up your claim. They may be fined and asked to pay for the amount you spent in hiring a lawyer and punitive damages that can reach up to $1,000.

What to Do When You Receive a Call or E-mail from a Debt Collector

1. Keep a copy or take note of all communications – the first thing that you need to do is to make sure that you take note of the contacts received from the collector. As mentioned, you must keep a copy of all the e-mails or letters sent to you, including the messages or requests that you send back to them.

2. Determine if you really owe the debt – if you’re not aware of the said debt or you know that you have already paid it, verify with the major credit bureaus to see if it’s in your credit history and it has been proved. You are given one free credit report each year from these bureaus. If there’s no proof that it’s your debt, send a dispute and the collector must prove it within a certain period or it will be removed from your credit history. This is important as it can affect your credit score. The collector should also stop collecting money from you if they could not present any proof.

3. Negotiate for Payment – if you really owe the debt, you should only pay off what you owe and not beyond that. Furthermore, you may negotiate to pay the debt with what’s convenient for you.

The best way to avoid this situation is to pay your debts on time. However, if the debt is not yours or it has already been paid, you can make the appropriate actions to straight things out.

Photo Attribution:

Featured and 1st image by see page for author [Public domain], via Wikimedia Commons

2nd image by David Castillo Dominici / FreeDigitalPhotos.net