Financial Challenges for Gen Z: Preparing for Financial Independence

Young adults today face numerous financial challenges that hinder their path to financial independence. From educational debt and student loans to the high cost of housing and rent, Gen Z individuals are burdened with significant financial obligations before even starting their professional journeys. Navigating the gig economy and job instability further adds to their financial uncertainty. Additionally, building and managing credit in the digital age presents its own set of challenges. This article explores these financial hurdles and offers insights on how Gen Z can effectively manage their finances to overcome these obstacles and achieve long-term financial independence.

Educational Debt and Student Loans

Many young people face financial difficulties, particularly with regard to student loans. Due to rising education costs, Gen Z students are incurring significant loan debt before beginning their jobs. This debt may limit their financial independence and ability to make life decisions such as purchasing a home or having children. As they negotiate loan repayment, Generation Z must understand their financial obligations and discover solutions to manage and combat their educational debt.

High Cost of Housing and Rent

High housing and rent prices are just another financial impediment for Generation Zs pursuing financial independence. As their careers progress, many young workers face increased housing costs and rental prices. This makes saving money, investing in their future, and thinking about home ownership more difficult. High housing costs may jeopardize their financial independence by prohibiting them from saving. To solve this financial challenge, Generation Z must explore alternative housing options, budget carefully, and locate suitable living arrangements.

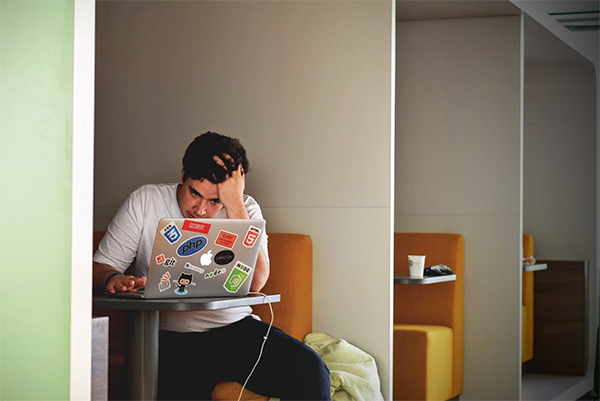

Navigating the Gig Economy and Job Instability

The gig economy and job instability present unique challenges for Gen Z individuals as they strive for financial independence. With the rise of freelance work and temporary employment, traditional notions of job security have become increasingly elusive. Gen Z individuals often find themselves navigating a landscape where stable, long-term employment is scarce. This lack of job stability can lead to financial uncertainty, making it difficult to plan for the future, save for emergencies, or invest in their long-term goals. To overcome this challenge, Gen Z must adapt to the changing job market, develop versatile skill sets, and explore opportunities for multiple streams of income to ensure a more stable financial future.

Building and Managing Credit in a Digital Age

In the digital age, Gen Z financial independence seekers have unique challenges in establishing and retaining credit. With the advent of online transactions and digital financial services, this generation must understand credit and its financial implications. Loans, mortgages, and other financial opportunities need excellent credit. However, the ease and speed with which online purchases may be made can lead to compulsive spending and debt. To protect their financial future, Generation Z must navigate the digital world with caution, make informed credit decisions, maintain their credit scores, and build healthy financial habits.

The financial challenges faced by Gen Z individuals in terms of educational debt, high housing costs, job instability, and credit management are significant obstacles on their path to achieving financial independence. These challenges require proactive measures and a comprehensive understanding of personal finance. By developing strategies to effectively manage their educational debt, exploring alternative housing options, adapting to the changing job market, and navigating the digital landscape responsibly, Gen Z can overcome these hurdles and pave the way towards a secure financial future. It is crucial for this generation to prioritize financial literacy and make informed decisions to ensure long-term financial stability.

Photo Attribution:

Featured & 1st image by: https://unsplash.com/photos/focus-photography-of-person-counting-dollar-banknotes–8a5eJ1-mmQ

2nd image by: https://unsplash.com/photos/man-wearing-white-top-using-macbook-1K9T5YiZ2WU