Debt Reduction Strategies Achieving Financial Peace of Mind

A cornerstone of attaining long-term stability and independence is good money management. Your financial terrain will be navigable with confidence if you carefully arrange your money, give debt top priority, and build savings. This all-encompassing strategy not only solves urgent financial problems but also provides the foundation for a safe future, therefore enabling you to make wise decisions consistent with your long-term objectives.

Creating a Budget and Tracking Expenses

Effective debt management depends on a well-defined financial plan. To have a whole picture of your financial situation, start by noting all sources of income together with fixed and variable expenses. Track expenditure using budgeting tools or apps to keep within your means. Reviewing and changing your budget on a regular basis helps you to better control discretionary spending, therefore releasing money to be used toward debt repayment. This proactive strategy helps you to develop financial discipline as well as equips you to make wise decisions, thereby enabling a safer financial future.

Prioritizing Debt Repayment

By concentrating on the most urgent debts, your path to financial independence will be much hastened. To find which debt is costing you the most, first list all of your debts, including interest rates and outstanding amounts. Think about applying the avalanche approach, in which you initially address high-interest debt, or the snowball approach, which stresses fast victories by paying off lesser debt. Maintaining minimal payments on other obligations while allocating extra money towards these top priorities will help to build momentum as you watch debts drop, this focused strategy not only lowers the overall interest paid over time but also offers encouragement.

Exploring Debt Consolidation Options

Consolidating several loans into one payment helps to simplify financial management and maybe reduce interest rates. Investigate several debt consolidation choices—personal loans, balance transfer credit cards, home equity loans—to see which best fits your circumstances. Every choice comes with terms and conditions, thus it’s important to consider the whole cost including interest rates and fees. Consolidating helps you to simplify your payments and concentrate on one monthly responsibility, therefore enabling you to keep on track with your repayment schedule and finally reach financial stability.

Building an Emergency Fund and Long-Term Savings

Maintaining stability while juggling debt depends on building a financial safety net. Start by saving a little bit every month to build an emergency fund—ideally covering three to six months’ worth of living expenses. This reserve helps to avoid depending too much on credit cards in unanticipated circumstances, therefore lowering the risk of debt building. At the same time, even if the sums are little, think about helping to fund long-term savings or retirement accounts. As you pursue debt reduction and future financial goals, maintaining both an emergency fund and savings can not only improve your financial stability but also offer peace of mind.

Those that use a methodical approach to budgeting, give debt first priority, investigate consolidation choices, and create a financial safety net will be better able to negotiate their financial situation. Along with addressing urgent debt issues, this all-encompassing approach creates the foundation for long-term financial stability and resilience. As you develop these behaviors, you enable yourself to make wise financial decisions that support a more steady and rich future.

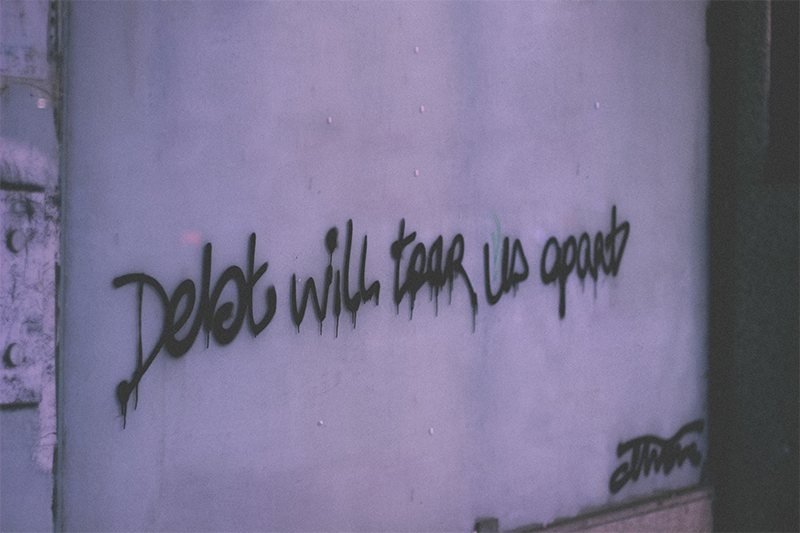

Photo Attribution:

Featured and 1st Image by https://unsplash.com/photos/debt-will-tear-us-apart-wall-decor-zuwx2tvI_iM

2nd Image by https://unsplash.com/photos/a-couple-of-keys-are-sitting-in-a-holder-dEwvH-LlpWc