The Best Ways to Save for a Big Purchase

Making major expenditures more realistic and controllable starts with a budgetary objective. Establishing a specific goal and creating a disciplined strategy helps people negotiate the complexity of saving with more assurance. Along with figuring the overall cost of the desired item, this method calls for careful budgeting and investigating several savings choices. Maintaining motivation over this road is absolutely vital since it keeps one committed to the ultimate goal and sharpens concentration.

Setting a Goal

Planning for a major purchase calls for a defined target amount. Find the whole cost of the item you want to purchase, including any extra charges including taxes, shipping, or maintenance. Divide the total into reasonable monthly savings targets to help you to feel less overwhelmed. To keep oneself driven, think about creating a purchase schedule. Frequent assessment of your development will also help you keep on track and modify your savings plan as necessary, so guaranteeing that you keep concentrated on reaching your financial goal.

Creating a Budget

Effective saving requires a budget developed from scratch. First, figure your monthly revenue and identify your fixed and variable costs. To free up more money, find places where you might cut back, including subscription services or dining out. Treat your savings goal—a certain amount of your income—as a non-negotiable expense. Monitoring your expenditure will enable you to remain responsible and make required changes. Frequent review and improvement of your budget guarantees that you stay in line with your financial goals, thereby guiding you toward that large buy.

Exploring Savings Options

Examining several savings choices will help you far more likely to meet your financial objective. While high-yield accounts give better interest rates for your investment, traditional savings accounts give security and simple access. Think about committed savings accounts made especially for big purchases since they usually have tools meant to inspire saving. Investigate certificates of deposit (CDs) for a specified term as well; these can provide more returns but you must lock in your money for a predetermined length of time. By looking at several financial institutions, you can identify the finest terms and rates that fit your saving plan.

Staying Motivated

While keeping excitement all through your saving path can be difficult, success depends on this. Making a vision board or keeping a picture of the object you wish in front of you will help you to clearly envision your objective. Celebrate little victories as you go to recognize your development, which will increase your drive. For support and responsibility, think about telling friends or relatives your objective. Remind yourself also of the advantages and delight the purchase will offer, therefore strengthening your resolve to save and enabling you to resist the impulse to buy extraneous goods.

Reaching a major purchase calls for constant inspiration, rigorous saving, and thorough planning. You can confidently negotiate the financial road by clearly defining goals, building a reasonable budget, investigating appropriate savings choices, and discovering means of inspiration. Every action you do puts you closer to your intended object, thereby turning the process into a fulfilling experience that not only satisfies your needs but also improves your financial discipline for next projects.

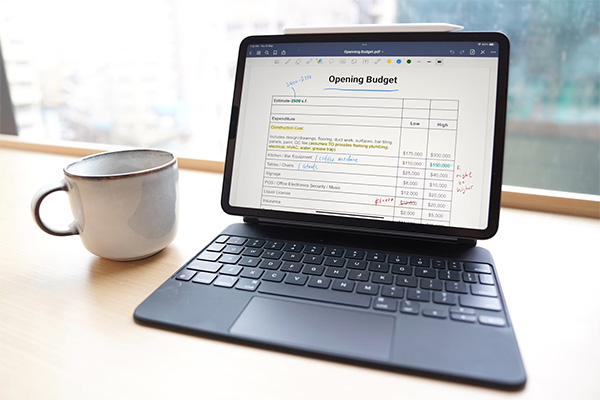

Photo Attribution:

1st & featured image by https://unsplash.com/photos/person-using-laptop-computer-holding-card-Q59HmzK38eQ

2nd image by https://unsplash.com/photos/a-laptop-and-a-cup-of-coffee-y356dQxeMn0