Navigating the World of Private Equity: Opportunities and Risks

With their emphasis on purchasing and improving the value of private or public businesses, private equity investments constitute a vibrant part of the financial scene. This asset class gives investors the chance to interact closely with companies using customized plans to increase profitability and development. Knowing the subtleties of private equity becomes crucial for spotting profitable prospects and properly controlling natural risks as investors negotiate this challenging environment. Participants can set themselves to get significant returns and help their portfolio firms to be long-term successful by using strategic insights and operational knowledge.

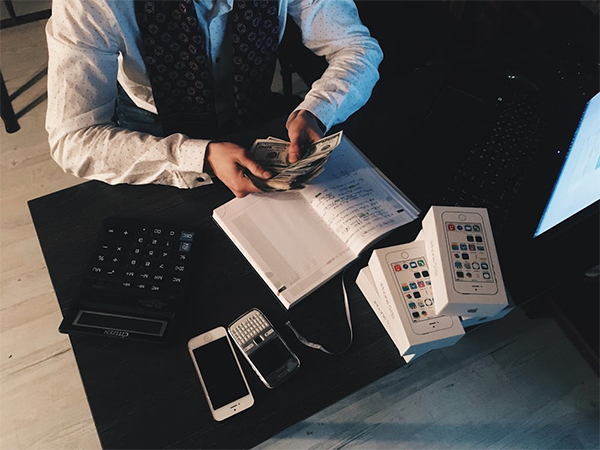

Understanding Private Equity Investments

Usually aiming for private or public enterprises to delist, private equity investments entail funds not listed on public markets. Seeking large returns via strategic management and operational enhancements, investors pool funds to purchase interests in these companies. Usually spanning several years, the investment horizon is long-term as businesses try to improve value before leaving via sales or public offers. Potential investors must grasp the subtleties of this asset class since it comprises several strategies with different risk profiles and possible rewards: leveraged buyouts, venture capital, and growth equity.

Evaluating Opportunities in Private Equity

Finding interesting investment prospects calls for careful study of corporate foundations, market trends, and competitive environments. To determine the feasibility of the target firm, investors should evaluate its management team, financial situation, and development capacity. To find any concealed hazards, due care must cover legal, operational, and financial assessments. Moreover, knowing the macroeconomic elements and sector dynamics helps one to have comprehension of possible returns. Using data analytics and networking with business leaders can help to improve decision-making and guarantee that expenditures match risk tolerance and strategic objectives. In private equity, a rigorous approach to opportunity assessment can greatly affect general investment success.

Managing Risks in Private Equity Investments

In private equity, effectively reducing risks calls for a multifarious approach combining active portfolio management, diversification, and careful due diligence. To lower their risk to any one entity, investors should distribute their cash throughout several sectors and phases of investing. Clear performance criteria and regular portfolio company monitoring help to enable quick interventions when problems develop. Furthermore improving control involves establishing good policies and keeping open lines of contact with management teams. Furthermore, knowing the state of the market and economic data helps one to foresee possible downturns, which facilitates proactive changes in investment plans protecting profits and reducing losses.

Strategies for Success in Private Equity

Success in private equity depends on operational knowledge, strategic planning, and market understanding taken together. Creating a clear investment thesis helps direct decisions and brings the company’s goals into line with possible prospects. Establishing close ties with management teams promotes cooperation and helps investors to carry out initiatives for value-creation with efficiency. Using industry knowledge helps one find operational efficiency and special development engines inside portfolio companies. Crucially also is keeping adaptability to fit evolving market conditions and new trends. Whether via public offers or sales, a rigorous exit strategy guarantees that investments are realised at ideal moments, therefore maximising profits for stakeholders.

For those ready to negotiate their complexity and inherent hazards, private equity investments offer a special opportunity. Investors can release great value in private companies by using a strategic strategy stressing careful analysis, proactive risk management, and close relationships with management teams. The success of these investments will ultimately depend on your capacity to adjust to changing market conditions and carry out well-timed exits; so, a thorough awareness of the private equity scene is absolutely necessary to get the desired results.

Photo Attribution:

1st & featured image by https://www.pexels.com/photo/gold-bar-lot-47047/

2nd image by https://www.pexels.com/photo/accountant-counting-money-210990/